UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material |

RESOURCES CONNECTION, INC.

(Name of Registrant as Specified in Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if Other Thanother than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| ☐ | Fee paid previously with preliminary | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing Party:

| |||

| (4) | Date Filed:

| |||

September 15, 20179, 2021

Dear Stockholder:

On behalf

Our purpose at RGP is to ignite the power of human agility. Human agility affords opportunity for talent to work in new ways and for clients to drive transformation with speed and efficiency. Our business model is particularly salient now emerging from the deep impacts of a global pandemic. We align to the Now of Work – bringing flexibility, global reach, continuous learning, virtual delivery, modular project work, and purpose to professional services. We are different than the Big Four for good reason and our client base, comprised of many of the world’s most beloved brands, are increasingly taking notice. While fiscal 2021 began in crisis and lockdown mode across the globe, we steadily grew throughout the year and finished by delivering year over year revenue growth in the fourth quarter as compared to the fourth quarter of fiscal 2020 on a same day constant currency basis. Despite the crisis environment, we also improved our cost structure and operational efficiency, positioning us for better profitability in the future. Given the macro changes in how work will be accomplished in the post-COVID era, we believe we have a brand experience and business model that will drive long-term, sustainable growth. We are committed to our consultants, our clients and our community to deliver superior performance and corporate citizenship as we move through recovery. In doing so, we are excited to provide more transparent communication, including information about our governance, diversity, equity and inclusion commitment and Board alignment and refreshment.

Stockholder Engagement

We continue to build a more robust approach to stockholder engagement through frequent, open and focused communication. During fiscal 2021, we participated in many investor roadshows on various virtual platforms and have appreciated the opportunity to be more interactive through technology. We welcome dialogue with our stockholders and thank those of Directors, you who have been actively engaged in return. We are hosting our first investor day on October 13, 2021 in New York City and invite you all to attend. We will be diving deeper into our Human Agility research, digital agenda, ESG commitment and our numbers.

DE&I

Diversity, equity and inclusion (“DE&I”) is a critical element of our human-first brand. We are extremely proud of our ability to attract and retain diverse talent. Our commitment to DE&I guides our conduct in our interactions with both clients and each other. We recognize diversity as a strength that is cultivated through our culture, our people, our business and our clients. Please review this Proxy Statement and our Annual Report for fiscal 2021 for a more robust disclosure of our outstanding gender and racial diversity representation, as well as our other important corporate social responsibility initiatives.

Board Refreshment & Alignment

During the past 12 months, we have welcomed two new Board members: Lisa Pierozzi and David White. Both are exceptional additions to our Board as they bring executive management skills and a passion for client service and people. In this Proxy Statement, we are announcing that Mike Wargotz is not standing for reelection. Throughout his tenure on our Board, Mike Wargotz has operated with distinction and excellence, and we thank him for his exceptional service. We will continue our refreshment efforts in the coming year as we also take the Board size down and increase diversity. In our search for new Board members, we seek the same values that guide our talent strategies – integrity, intellectual rigor, accountability and diversity of backgrounds, skills and attributes.

2021 Annual Meeting

We cordially invitedinvite you to attend the 2017our 2021 Annual Meeting of Stockholders of Resources Connection, Inc., to be held at 1:30 p.m. Pacific Time, on October 19, 2017,21, 2021, at the Company’s headquarters in Irvine, California. The formal noticeNotice of the Annual Meeting appears on the following page. The attached Notice of Annual Meetingpage and Proxy Statement describe the matters we expect to be acted upon at the Annual Meeting.

During the Annual Meeting, stockholders will have the opportunity to ask questions. Whether or not you plan to attend the Annual Meeting, it is important your shares be represented. Regardless ofPlease follow the number of shares you own, please sign and date the enclosed proxy card and promptly return it to us in the enclosed postage-prepaid envelope. Alternatively, as discussed in the Question and Answer section of the Proxy Statement, you may be eligibledirections below to vote electronically over the Internet or by telephone. If you sign and return your proxy card without specifying your choices, your shares will be voted in accordance witha timely manner.

We thank you for your ownership and are grateful for your support in helping us change the recommendations ofway the Board of Directors contained in the Proxy Statement.

world works. We look forward to seeingthe year ahead and hope to see you on October 19, 2017,at our Investor Day and urge you to return your proxy as soon as possible.Annual Meeting.

| Sincerely, | ||

| ||

| Kate W. Duchene | ||

| President and Chief Executive Officer | ||

Sincerely,

Kate W. Duchene

Chief Executive Officer

RESOURCES CONNECTION, INC.

17101 ARMSTRONG AVENUE

IRVINE, CALIFORNIA 92614

(714) 430-6400

NOTICE OF 20172021 ANNUAL MEETING OF STOCKHOLDERS

| 1:30 p.m., Pacific Time, on Thursday, October | |||

Resources Connection, Inc. 17101 Armstrong Avenue, Irvine, California | |||

| (1) |

| ||

| (2) |

| ||

| (3) |

| ||

| (4) |

| ||

| |||

| August | |||

| It is important that your shares be represented and voted at the Annual Meeting. | |||

| * | We intend to |

PROXY STATEMENT

We are sending this Proxy Statement (“Proxy Statement”) to you, the stockholders of Resources Connection, Inc. (“Resources Connection”RGP,” “we” or “the Company”the “Company”), a Delaware corporation, as part of our Board of Directors’ (our “Board’s”) solicitation of proxies to be voted at our 20172021 Annual Meeting of Stockholders (“Annual Meeting”) to be held at the Company’s headquarters in Irvine, California, at 1:30 p.m., Pacific Time, on October 19, 2017,21, 2021, and at any postponements or adjournments thereof. This Proxy Statement and accompanying form of proxyour 2021 Annual Report on Form 10-K, which includes our fiscal 2021 financial statements (“Annual Report”) were first sent or made available to stockholders on or about September 15, 2017.9, 2021.

We are enclosing a copy of our 2017 Annual Report to Stockholders (“Annual Report”), which includes our fiscal 2017 financial statements. Our Annual Report is not, however, part of the proxy materials.

Important Notice Regarding the Availability of Proxy Materials for the Stockholder Meeting to Be Held on October 19, 2017.21, 2021.

This Proxy Statement and our Annual Report are available electronically at www.proxyvote.com. Copies of these materials are also available electronically on the Company’s website athttp:https://ir.rgp.com/annuals-proxies.cfmfinancials-filings/annual-reports-and-proxies. The other information on our corporate website does not constitute part of this Proxy Statement.

| Forward Looking Statements | 5 | |||

| 6 | ||||

| 6 | ||||

| 7 | ||||

| Stockholder Return | 7 | |||

| Corporate Social Responsibility and Sustainability Highlights | 8 | |||

| Annual Meeting | 9 | |||

| Meeting Agenda | 9 | |||

| Voting Matters | 10 | |||

| Questions and Answers | 14 | |||

| 18 | ||||

| 19 | ||||

| Continuing Directors | 21 | |||

| 24 | ||||

| Board of Directors | 25 | |||

| 25 | ||||

| 26 | ||||

| 26 | ||||

| 26 | ||||

| 26 | ||||

| 27 | ||||

| 28 | ||||

| 29 | ||||

| 29 | ||||

| 30 | ||||

| 30 | ||||

Corporate Governance Guidelines and Code of Business Conduct and Ethics | 30 | |||

| 31 | ||||

| 31 | ||||

| 32 | ||||

| 32 | ||||

| Environmental Responsibility | 34 | |||

| Director Compensation | 35 | |||

| 35 | ||||

| 35 | ||||

| 37 | ||||

| 38 | ||||

| 38 | ||||

| 40 | ||||

Security Ownership of Certain Beneficial Owners and Management | 40 | |||

| 43 | ||||

| 43 | ||||

| 43 | ||||

| 44 | ||||

Executive Compensation — Compensation Discussion and Analysis | 45 | |||

| 45 | ||||

| 45 | ||||

| 46 | ||||

| 46 | ||||

| 47 | ||||

| 48 | ||||

| 48 |

| 49 | ||||

| 50 | ||||

| 50 | ||||

| 50 | ||||

| 52 | ||||

| 53 | ||||

| 53 | ||||

| 53 | ||||

| 54 | ||||

| 54 | ||||

| 54 | ||||

| 55 | ||||

| 55 | ||||

| 56 | ||||

Summary Compensation Table — Fiscal | 56 | |||

| 57 | ||||

| 58 | ||||

| 58 | ||||

| 59 | ||||

| 60 | ||||

| 61 | ||||

| 61 | ||||

| 62 | ||||

| 63 | ||||

| CEO Pay Ratio Disclosure | 64 | |||

| Proposal 3. Advisory Vote on the Company’s Executive Compensation | 65 | |||

| 68 |

2017FORWARD LOOKING STATEMENTS

Certain statements in this Proxy Statement are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934 (the “Exchange Act”). Such forward-looking statements may be identified by words such as “anticipates,” “believes,” “can,” “continue,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “remain,” “should,” or “will” or the negative of these terms or other comparable terminology. In this Proxy Statement, such statements include statements regarding the expected impact of the ongoing COVID-19 pandemic (the “Pandemic”), our growth and operational plans, including the strength of our pipeline, and expectations regarding macro trends. Such statements and all phases of the Company’s operations are subject to known and unknown risks, uncertainties and other factors that could cause our actual results, levels of activity, performance or achievements and those of our industry to differ materially from those expressed or implied by these forward-looking statements. Risks and uncertainties include uncertainties regarding the impact of the Pandemic on our business and the economy generally, our ability to successfully execute on our strategic initiatives, our ability to realize the level of benefit that we expect from our restructuring initiatives, our ability to compete effectively in the highly competitive professional services market and to secure new projects from clients, our ability to successfully integrate any acquired companies, overall economic conditions and other factors and uncertainties as are identified in our most recent Annual Report on Form 10-K for the year ended May 29, 2021 and our other public filings made with the U.S. Securities and Exchange Commission (the “SEC”) (File No. 000-32113). Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also affect our business or operating results. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. The Company does not intend, and undertakes no obligation, to update the forward-looking statements in this Proxy Statement to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events, unless required by law to do so.

This summary highlights information contained elsewhere in this Proxy Statement. The following description is only a summary. For more complete information about these topics, please review our Annual Report, which contains our financial statements, and read the entire Proxy Statement carefully before voting.

Although the Pandemic continued to bring challenges to the global economy and our business during fiscal 2021, including work-from-home government mandates across the world and the global suspension of business travel, it has also reinforced the importance of one of our foundational tenets: operational agility.

Notwithstanding the disruptions caused by the Pandemic, we are stable and growing our core business, particularly through strategic client and industry vertical programs, and our population is healthy. In fiscal 2021, our overall productivity remained high. While the prolonged adverse impact from the Pandemic significantly impacted our operating results throughout fiscal 2021, we have experienced a steady recovery in each sequential quarter after reaching a trough in revenue during the first quarter of fiscal 2021. In the fourth quarter of fiscal 2021, the revenue exceeded the first quarter of fiscal 2021 by 16.9% and returned to year over year growth compared to the fourth quarter of fiscal 2020 on a same day constant currency basis(1). Additionally, as we continued to right size and optimize our cost structure globally, we delivered solid cash flows and profit margins. Given our balance sheet and liquidity position, we believe we have the financial flexibility and resources needed to operate in an economic environment with continued uncertainty.

The impact of the Pandemic did not just affect us and our industry. We have all been impacted. Therefore, instead of focusing exclusively on the disruption, we choose to be optimistic, search for opportunities, and focus on what we can control – such as reducing costs, further investment in digital innovation, and embracing and enhancing our agile operating model with borderless talent.

While the impact of the Pandemic and the resulting restrictions imposed from time to time have undoubtedly caused disruptions in the U.S. and global economy and may continue to unsettle financial markets and global economic activities, we have been resourceful in bringing solutions to our clients despite the required restrictions, viewing the new ways of working as an opportunity, and above all else, have remained agile. As always, we thank you, our stockholders, for your continued support.

| (1) | See page 30 of Resources Connection, Inc.’s Annual Report on Form 10-K, filed with the SEC on July 23, 2021, for a discussion of the adjustments made and a reconciliation of those adjustments to revenue, the most directly comparable U.S. generally accepted accounting principles (“GAAP”) financial measure, to compute same day constant currency revenue. |

We achieved 8.2% or $18.7 million in cost reduction for fiscal 2021, including (i) $12.5 million or 9.1% reduction in management compensation and (ii) $3.5 million or 19.8% savings in occupancy costs by shrinking over 60,000 square feet in real estate footprint;

| • | We achieved Adjusted EBITDA (earnings before interest, taxes, depreciation and amortization, |

| • | We achieved an Adjusted EBITDA Margin of |

We generated diluted earnings per share of $0.56$0.78 for fiscal 2017; and

We generated $39.9 million in cash flow from operations;

Our financial position is strong withThe 10.5% decline in revenue in fiscal 2021 reflected the adverse impact of the Pandemic and fewer business days in fiscal 2021. Revenue level troughed during the first quarter of fiscal 2021 and has since recovered steadily beginning in the second fiscal quarter as vaccine development advanced and uncertainties related to the Pandemic began to subside. With improved operating leverage and cost structure, we generated $39.9 million in cash of approximately $62.3 million and $28.3 million of cash provided byfrom operating activities in fiscal 2017.2021. As of May 29, 2021, we had $74.4 million in cash and cash equivalents and $75.5 million available for borrowing under our $120 million secured revolving credit facility with Bank of America. Given our balance sheet and liquidity position, we believe we have the financial flexibility and resources needed to operate in the current uncertain economic environment. Our continued ability to continue to generate cash allows us the flexibility of returningto return cash to you, our stockholders, while being opportunistic on investments for our future growth. Additionally, the Company entered into a $120 million secured revolving credit facility (“Facility”) with Bank of America in October 2016. The Facility is available for working capital and general corporate purposes, including potential acquisitions and stock repurchases. On November 21, 2016, the Company completed its Dutch auction tender offer, purchasing approximately 6.5 million shares of the Company’s common stock for approximately $104.2 million, excluding transaction costs, funded partially by borrowing $58.0 million under the Facility and using $46.2 million of cash on hand. As of the end of fiscal 2017, approximately $71 million remained available for borrowing under the Facility.

We returned approximately $133.1$18.2 million to stockholders during fiscal 20172021 through our dividend program which we kept intact despite the Pandemic. In an effort to ensure a strong liquidity position during the Pandemic, we did not make any share repurchase and dividend programs, as well as the repurchase of sharesrepurchases in the modified Dutch tender offer. Infiscal 2021. However, in the past three fiscal years, we have returned a cumulative total of almost $213.3$86.9 million to our stockholders through our share repurchase and dividend programs and the repurchase of shares in the modified Dutch tender offer.

program. We believe that the payment of a regular dividend, along with the continuancecontinuation of our stock repurchase plan givesas circumstances permit, provides us the ability to consistently return cash to our stockholders with consistency.stockholders.

Issuance of Quarterly Dividend:

In July 2010, our Board of Directors authorized the establishment of a regular quarterly dividend, subject to quarterly Board approval. This dividend has been increased each year since its introduction. InConsistent with prior quarters, in July 2017,2021, our Board authorized the payment of Directors approved a 9% increase in the quarterly dividend to $0.12at $0.14 per share. Our next dividend payment is payable on September 23, 2021 to all stockholders of record on August 26, 2021.

ShareStock Repurchase:

In July 2015, our Board of Directors approved a new sharestock repurchase program authorizing the purchase,repurchase, at the discretion of the Company’sour senior executives, of our common stock with anfor a designated aggregate dollar limit not to exceed $150 million. During the year ended May 29, 2021, the Company did not make any repurchases of its common stock on the open market. As of May 29, 2021, approximately $85.1 million remained available for future repurchases of our common stock under the July 2015 program.

(2) | See |

(3) | Adjusted EBITDA Margin |

CORPORATE SOCIAL RESPONSIBILITY AND SUSTAINABILITY HIGHLIGHTS

exceed $150 million. The program commencedCompany and our Board maintain a focus on corporate social responsibility and sustainability. We continuously look for new and better ways to foster a diverse and inclusive work environment, minimize our environmental impact and engage our surrounding communities, all while creating value for our stockholders. Below are some recent highlights of our diversity and sustainability initiatives. For additional information, see “Corporate Social Responsibility and Sustainability” beginning on page 32.

| In fiscal 2021, we established a North American Diversity Council and a global Diversity Ambassador program, consisting of team members from around the world and from various functions. The Diversity Council and Diversity Ambassadors serve important roles in working closely with senior leaders to facilitate alignment between our DE&I efforts and overall business strategy of promoting human capital practices that support and accelerate our DE&I goals. | ||

| • | Sustainability. As a global human capital company, our environmental footprint is relatively small. We nevertheless continue to take actions to reduce our footprint and be environmentally responsible, including (1) reducing our global real estate footprint by over 60,000 square feet during fiscal 2021 by creating designated virtual offices, utilizing shared work spaces and expanding our use of technology to allow more employees to work virtually; (2) reducing our use of paper by transitioning more than 95% of client invoices to electronic billing, implementing electronic paystubs for all US employees and reducing our use of print-based marketing materials in favor of digital assets; and (3) minimizing our Company’s carbon emissions through reduced air travel and commuting due to our use of virtual offices and hybrid approach to remote and in-office work and maximizing the use of technology for virtual meetings. |

MANAGEMENT HIGHLIGHTS

Fiscal 2017 was a year of change for the Company. Our Chief Executive Officer and our Chief Financial Officer retired. We formed a new executive team with redefined functional roles to drive a refined strategic vision for the Company, and developed an execution plan for the next five years. We completed a reductioncommitment toward this Fund in force with a goal to take approximately $7.0 million of cost out of our SG&A per year, affecting approximately 50 management employees. The following are the most significant changes to the management team in order of occurrence:

Change in the Chief Financial Officer

Nathan Franke, our Executive Vice President & Chief Financial Officer since 2007, retired effective August 26, 2016. Effective August 29, 2016, Herbert M. Mueller was promoted to the position of Executive Vice President and Chief Financial Officer to replace Mr. Franke. Mr. Mueller joined the Company in 2012 and previously served as Managing Director of our Atlanta, Georgia office with full oversight and operations responsibility for that practice office.

Appointment of a Chief Accounting Officer

On August 17, 2016, the Company announced the promotion of John D. Bower to the newly-created position of Chief Accounting Officer. Mr. Bower reports to the Chief Financial Officer. Since 2005, Mr. Bower served the Company as Senior Vice President, Finance. In that role, Mr. Bower was the senior finance leader responsible for the Company’s financial reporting and financial operations.

Change in the Chief Executive Officer

On October 7, 2016, Anthony C. Cherbak, President and Chief Executive Officer retired from the Company due to health issues. Mr. Cherbak has and will continue to serve the Company as a member of the Board of Directors. Consistent with the Company’s Emergency Succession Plan, the Board of Directors appointed Kate W. Duchene to the role of Interim Chief Executive Officer.

On December 16, 2016, following a search process led by a Search Committee of the Board of Directors, the Board appointed Kate W. Duchene to serve as President and Chief Executive Officer of the Company. Prior to her appointment, Ms. Duchene held the role of Chief Legal Officer, Executive Vice President, Human Resources & Secretary, for the Company, positions she held since 2000.

Resignation of the Executive Vice-President — International Operations and Procurement & Supply Chain Management

On November 16, 2016, Tracy Stephens announced his decision to leave his position as Executive Vice-President — International Operations and Procurement & Supply Chain Management of the Company and his memberships on the Boards of Directors of the Company’s international subsidiaries or affiliates. Mr. Stephens left the Company effective as of December 31, 2016.

Date and Time: | 1:30 p.m., Pacific Time, on Thursday, October |

Place: | Resources Connection, Inc. |

17101 Armstrong Avenue, Irvine, California 92614

| 17101 Armstrong Avenue, Irvine, California 92614* |

| Record Date: | August 23, 2021 |

| Voting: | Stockholders as of the close of business on the record date are entitled to |

| * | In the event it is not possible or advisable to hold our Annual Meeting in person as currently planned due to the Pandemic, we may decide to hold the Annual Meeting virtually via the Internet. Please refer to the attached Notice of Annual Meeting for additional information. |

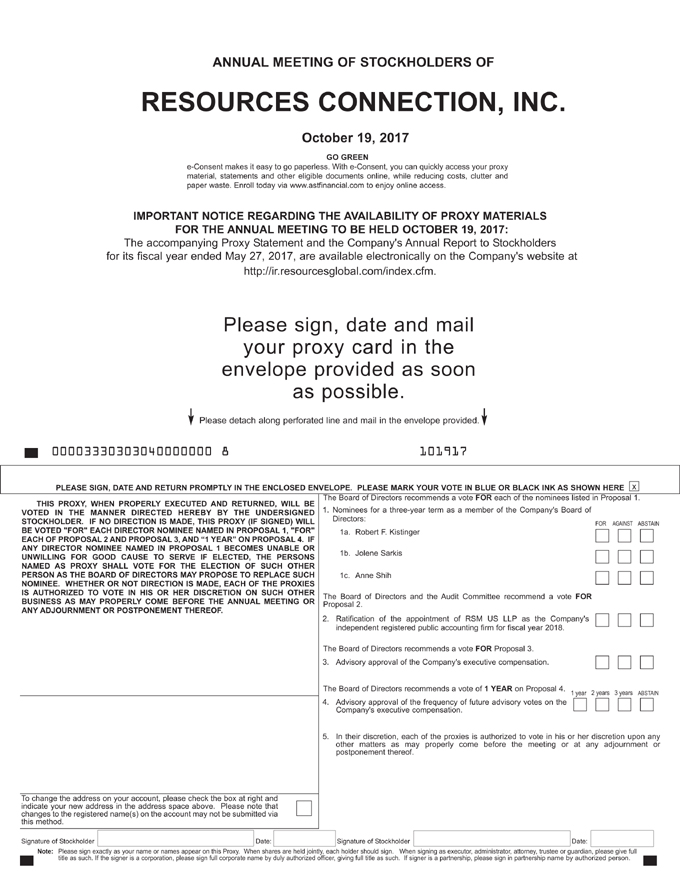

1. Election of three directors, each for a three-year term expiring at the Company’s annual meeting in 20202024 and until their respective successors are duly elected and qualified;

2. Ratification of the appointment of RSM US LLP as the Company’s independent registered public accounting firm for fiscal year 2018;2022;

3. Approval on an advisory basis of the Company’s executive compensation; and

4. Approval on an advisory basis of the frequency of future advisory votes on the Company’s executive compensation; and

5. Transaction of such other business as may properly come before the Annual Meeting or any postponements or adjournments thereof.

Detailed Information | ||

Proposal 1— Election of Three Directors for a Three-Year Term |

The following table provides summary information about each director nominee. More detailed information may be found in the section entitled “Proposal 1. Election of Directors.”

| Name and Principal Occupation | Age | Director Since | Board Committees |

| Donald B. Murray- Independent Chairman of the Board Former Chief Executive Officer, Resources Connection, Inc. | 74 | 1999 | None |

| Lisa M. Pierozzi- Independent Former Executive Vice President, Finance & Administration and Chief Financial Officer of the Motion Picture Association Former Partner of PwC (formerly Price Waterhouse) | 60 | 2021 | Audit Committee |

| A. Robert Pisano- Lead Independent Director Business Consultant and former interim Chief Executive Officer and President and Chief Operating Officer of the Motion Picture Association | 78 | 2002 | Compensation Committee Corporate Governance and Nominating Committee (Chair) |

Committee | ||||||||||||||||

Name | Age | Director | Background | Experience/ Qualification | Ind. | Comp | Audit | Nom/ Govern | ||||||||

Robert F. Kistinger | 64 | 2006 | Mr. Kistinger was the Chief Operating Officer of Bonita Banana Company from 2009 to 2014 and now continues to serve as an Executive Advisor to the company. He was formerly President and Chief Operating Officer of the Fresh Group of Chiquita Brands International, Inc. (“Chiquita”). Mr. Kistinger was employed at Chiquita for more than 27 years and held numerous senior management positions in accounting, financial analysis and strategic planning roles. Prior to joining Chiquita, Mr. Kistinger was with the accounting firm of Arthur | Mr. Kistinger has held leadership positions in large multinational companies with operations in Latin America, developing critical financial and international operations expertise. Mr. Kistinger’s knowledge, insight and experience are invaluable to the Company and to the Board as we continue to provide services and solutions to our clients around the world. | X | X | X | |||||||||

Committee | ||||||||||||||||

Name | Age | Director | Background | Experience/ Qualification | Ind. | Comp | Audit | Nom/ Govern | ||||||||

| Young & Company for six years and is a certified public accountant and a member of the American Institute of Certified Public Accountants | ||||||||||||||||

Jolene Sarkis | 67 | 2002 | Ms. Sarkis has been a private marketing and advertising consultant since 2001. Ms. Sarkis held various positions of responsibility for Time Inc. from 1985 to 2001 in sales and marketing, primarily for Time Inc.’s leading publications which include Time, People, Sports Illustrated, Fortune and Money. Ms. Sarkis served as Publisher of Fortune from 1996 to 2001 and, additionally, as President of Fortune from 1999 to 2001. She is currently Executive Vice President of CFS Restaurant Group, Inc., a position she has held since 2011. | Ms. Sarkis’ business experience in operations management and business development brings a unique skill set to the Board and to the Company in the critical areas of leadership and strategic planning, as well as marketing and human resources.. | X | X | ||||||||||

Anne Shih | 70 | 2007 | Ms. Shih is actively involved in many philanthropic endeavors, including her twenty years with the Bowers Museum in Santa Ana, California, where she currently serves as Chairwoman of the Board of Governors, a position she has held since 2010. Ms. Shih is an honorary president of the Chinese Cultural Arts Association, a position she has held since 2003 and was also Deputy Secretary of the Chinese Women’s League Los Angeles Chapter. In 2008, Ms. Shih was awarded a Certificate of Special Congressional Recognition from the U.S. Congress for her outstanding and invaluable service to the community. In 2010, Ms. Shih was made the first Official World Ambassador of Cultural Heritage for Shaanxi Province, China. | Ms. Shih’s strong business and personal relationships in Greater China are important to the Company and the Board as we expand our international footprint in Asia. | X | X | ||||||||||

Board Recommendation — FOR each of the Board’sThree Director Nominees

Detailed Information | ||

Proposal 2— Ratification of the appointment of RSM US LLP as the Company’s Independent Registered Public Accounting Firm for Fiscal Year |

For more detailed information on the appointment of RSM US LLP, please refer to the detailed information in “Proposal 2. Ratification of Appointment of Independent Registered Public Accounting Firm for Fiscal Year 2018.2022.”

ShareholderStockholder ratification of the appointment of RSM US LLP as our independent registered public accounting firm is not required by our Third Amended and Restated Bylaws (our “Bylaws”) or otherwise. However, theour Board is submitting the appointment of RSM US LLP to theour stockholders for ratificationsratification as a matter of good corporate governance. If the stockholders fail to ratify the appointment, the Audit Committee may reconsider whether or notthe decision to retain RSM US LLP. Even if the appointment is ratified, the Audit Committee, in its discretion, may appoint a different independent auditor at any time during the year if the Audit Committee determines that such a change would be in the best interestsinterest of the Company and our stockholders.

Set forth below is summary information with respect to RSM US LLP’s fees for services provided to the Company in fiscal 20172021 and fiscal 2016.2020.

| 2021 | 2020 | |||||||

| Audit Fees | $ | 1,227,535 | $ | 1,235,500 | ||||

| Audit Related Fees | $ | 52,400 | $ | 34,400 | ||||

| Tax Fees | $ | 6,500 | $ | 6,500 | ||||

| All Other Fees | $ | 0 | $ | 0 | ||||

| 2017 | 2016 | |||||||

Audit Fees | $ | 736,500 | $ | 689,400 | ||||

Audit Related Fees | — | — | ||||||

Tax Fees | $ | 9,500 | — | |||||

All Other Fees | — | — | ||||||

Board Recommendation — FOR ratification of the appointment of RSM US LLP as the Company’s Independent Registered Public Accounting Firm for Fiscal Year 20182022

Detailed Information | ||

Proposal 3— Advisory Vote on the Company’s Executive Compensation |

We are asking stockholders to approve, on an advisory basis, the Company’s executive compensation as disclosed pursuant to the SEC’s executive compensation disclosure rules and set forth in this Proxy Statement (including in the compensation tables and narratives accompanying those tables as well as the Compensation Discussion and Analysis). TheOur Board of Directors recommends aFOR vote because it believes that the Company’s executive compensation programs use appropriate structures and sound pay practices that are effective in achieving the Company’s core objectives of providing competitive pay, pay for performance, and alignment of management’s interests with the interests of long-term stockholders. In addition to reviewing the information in “Proposal 3. Advisory Vote on the Company’s Executive Compensation” and the executive compensation tables and corresponding narratives in this Proxy Statement, stockholders are encouraged to read the “Compensation Discussion and Analysis” section of this Proxy Statement for a more detailed discussion of how our compensation programs reflect our core objectives. Further, theour Board believes our executive compensation programs are reasonable in relation to comparable public and private companies in our industry.

Pay for Performance Orientation

| • |

For fiscal 2021, approximately 75% of our Chief Executive Officer’s and Chief Operating Officer’s, and 65% of our Chief Financial Officer’s, target total direct compensation(4) was not guaranteed but rather was tied to metrics related to Company performance and/or stock price, and therefore meaningfully “at risk”. |

| • | Base Salaries. To preserve cash in an uncertain marketplace during the Pandemic, the Compensation Committee determined not to increase the base salary of any NEO during fiscal 2021. |

• | Annual |

|

Ms. Duchene, our President and Chief Executive Officer, was awarded a total annual incentive of $438,685,$836,000, representing 33%37.2% of her maximum award opportunity or 75%111.5% of her target annual incentive opportunity;

Mr. Mueller Chief Financial Officer, was awarded a total annual incentive of $251,904,$391,000, representing 45%37.2% of her maximum award opportunity or 111.7% of her target annual incentive opportunity; and

Messrs. Cherbak and Franke were not eligible to receive a bonus under the EIP for fiscal 2017 because they both retired during fiscal 2017. Mr. Bower did not participate in the EIP for fiscal 2017 because the EIP for fiscal 2017 was approved prior to his appointment as Chief Accounting Officer. Mr. Bower was awarded a discretionary bonus of $175,000 for fiscal 2017.

| (4) | Target total direct compensation means the NEO’s base salary, target annual cash incentive and grant date fair value (based on the value approved by the Compensation Committee and used to determine the number of shares subject to the award) of annual long-term incentive awards granted to the NEO in fiscal 2021. |

| (5) | See pages 29 and 31 of Resources Connection, Inc.’s Annual Report on Form 10-K for the fiscal year ended May 29, 2021, filed with the SEC on July 23, 2021, for a discussion of the adjustments made and a reconciliation of those adjustments to net income, the most directly comparable GAAP financial measure, to compute Adjusted EBITDA. |

| (6) | Adjusted EBITDA Percentage for purposes of the EIP is total revenue minus the cost of services sold and Selling, General and Administration expense adjusted for stock compensation, changes in contingent consideration, Board approved restructuring and any additional items deemed appropriate by the Audit Committee, divided by revenue. |

| • | Long-Term |

The Company’s current policy is to provide stockholders with an opportunity to approve, on an advisory basis, the compensation of our NEOs each year at the annual meeting of stockholders. We have included in this Proxy Statement a proposal to approve the frequency of future advisory votes on the Company’s executive compensation and our Board of Directors recommends that we continue with the current policy of holding such a vote every year. Accordingly, itIt is expected that the next such vote will occur at the 20182022 annual meeting of stockholders.

Board Recommendation — FOR approval of the Company’s Executive Compensation

| ||

|

As set forth in Proposal 4, our stockholders are being provided the opportunity to cast an advisory vote on the frequency of future advisory votes on the compensation of our named executive officers. The Board recommends that our stockholders vote for an advisory vote on the Company’s executive compensation annually. While we believe a vote every year is the best choice for us, you are not voting to approve or disapprove the Board’s recommendation, but rather to make your own choice to have future advisory votes on executive compensation every year, every two years or every three years. You may also abstain from voting. Our Board values the opinions that our stockholders express in their votes and will take into account the outcome of the vote when determining the frequency of future advisory votes on the Company’s executive compensation.

Board Recommendation — 1 YEAR for the frequency of future advisory votes on the Company’s executive compensation

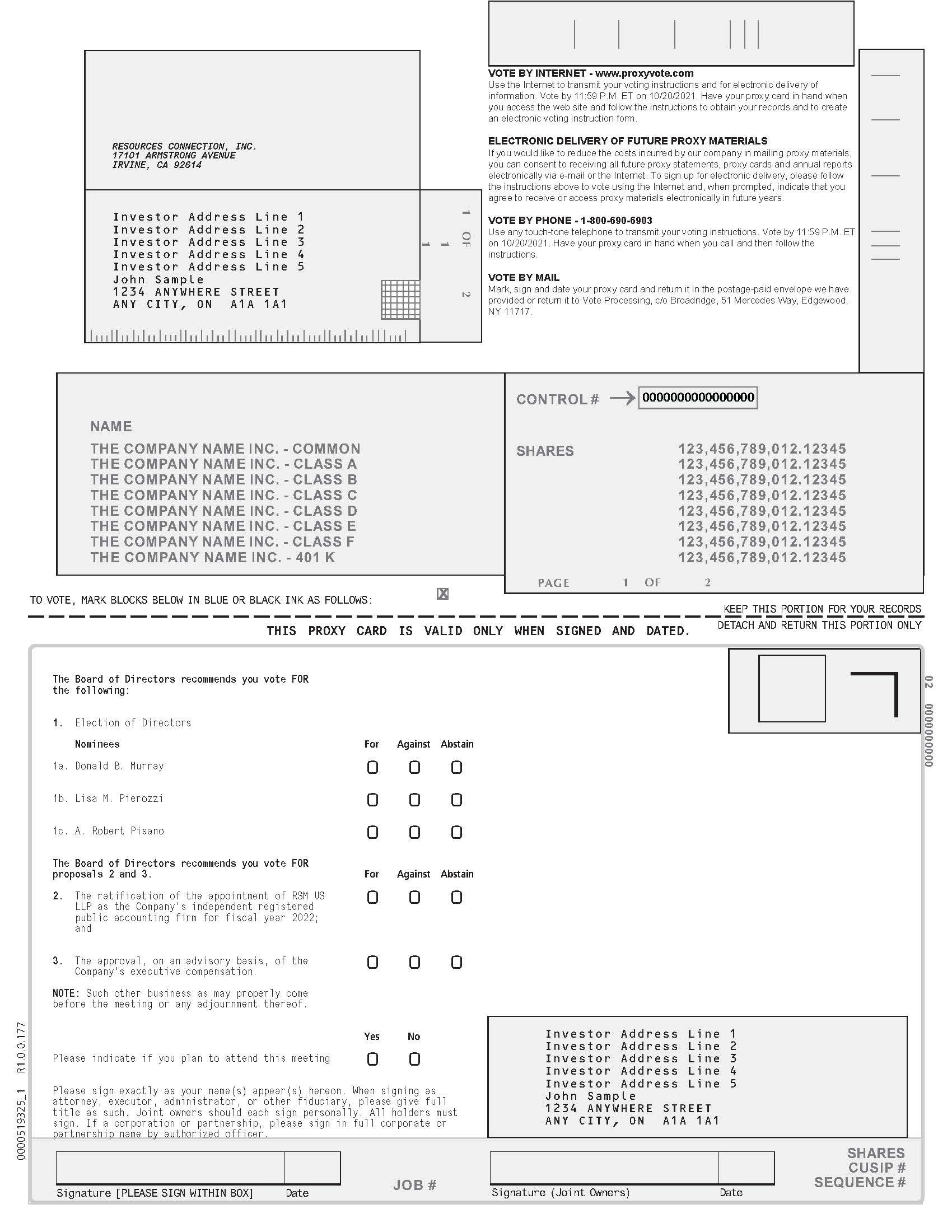

Why did I receive only a Notice of Internet Availability?

As permitted by SEC rules, we are furnishing proxy materials for the Annual Meeting primarily over the Internet. On or about September 9, 2021, we mailed to each of our stockholders (other than those who previously requested electronic delivery or to whom we are mailing a paper copy of the proxy materials) a Notice of Internet Availability containing instructions on how to access and review the proxy materials via the Internet and how to submit a proxy electronically using the Internet. The Notice of Internet Availability also contains instructions on how to receive, free of charge, paper copies of the proxy materials. If you received the Notice of Internet Availability, you will not receive a paper copy of the proxy materials unless you request one.

We believe the delivery options that we have chosen will allow us to provide our stockholders with the proxy materials they need, while lowering the cost of the delivery of the materials and reducing the environmental impact of printing and mailing paper copies.

What am I voting on?

At the Annual Meeting, our stockholders will be voting on the following proposals:

1. the election of three director nominees (Robert F. Kistinger, Jolene Sarkis(Donald B. Murray, Lisa M. Pierozzi, and Anne Shih)A. Robert Pisano) to our Board, of Directors, each for a three-year term expiring at the annual meeting in 20202024 and until his or her respective successor is duly elected and qualified;

2. the ratification of the appointment of RSM US LLP as the Company’s independent registered public accounting firm for fiscal year 2018;2022; and

3. the approval, on an advisory basis, of the Company’s executive compensation; and

4. the approval, on an advisory basis, of the frequency of future advisory votes on the Company’s executive compensation.

Our stockholders will also consider any other business properly raised at the Annual Meeting or any postponement or adjournment thereof.

How does the Board of Directors recommend I vote on each of the proposals?

Our Board of Directors recommends you voteFORelection to our Board of Directors of each of the three nominees for director named in Proposal 1 of this Proxy Statement;FORthe ratification of the appointment of RSM US LLP as our independent registered public accounting firm for fiscal 2018,2022, as outlined in Proposal 2 of this Proxy Statement; and FORthe approval, on an advisory basis, of the Company’s executive compensation, as outlined in Proposal 3 of this Proxy Statement; and1 YEAR with respect to the approval, on an advisory basis, of the frequency of future advisory votes on the Company’s executive compensation, as outlined in Proposal 4 of this Proxy Statement.

Who can attend the Annual Meeting?

All stockholders of the Company as of the close of business on August 24, 2017,23, 2021, the record date, can attend the Annual Meeting. If your shares are held through a broker, bank or nominee (that is, in “street name”), you are considered the beneficial holder of such shares, and if you would like to attend the Annual Meeting, you must either (1) write Alice J. Washington,to Lauren Elkerson, our General Counsel,Corporate Secretary, at 17101 Armstrong Avenue, Irvine, CA 92614; or (2) bring to the meeting a copy of your brokerage account statement or a “legal proxy” (which you can obtain from the broker, bank or nominee that holds your shares). Please note, however, that beneficial owners whose shares are held in “street name” by a broker, bank or nominee may vote their shares at the Annual Meeting only as described below under “Who is entitled to vote at the meeting?”

Who is entitled to vote at the meeting?

Stockholders of record, as of the close of business on August 24, 2017,23, 2021, the record date, are entitled to vote at the Annual Meeting. If you are the beneficial owner of shares held in “street name” through a broker, bank or nominee and held such shares as of the close of business on the record date, the proxy materials are being forwarded to you by your broker, bank or nominee together with a voting instruction form. Because a beneficial owner is not the stockholder of record, you may not vote these shares in person at the meeting unless you obtain a “legal proxy” from the broker, bank or nominee that holds your shares, giving you the right to vote the shares in person at the meeting. Even if you plan to attend the Annual Meeting, we recommend you submit your proxy or voting instructions in advance of the Annual Meeting so your vote will be counted if you later decide not to attend the Annual Meeting.

How do I vote?vote and what is the deadline?

Voting via the Internet, Telephone or Mail:

You may submit your proxy or voting instructions via the Internet, by telephone or by mail, depending on the manner in which you receive your proxy materials. If you received a Notice of Internet Availability by mail, you can vote on matters that properly come beforesubmit a proxy or

voting instructions via the meetingInternet by following the instructions provided in onethe Notice of two ways: (1)Internet Availability. If you received a printed set of the proxy materials by submittingmail, you may submit a proxy or voting instructions via the Internet, by telephone (if available) or by mail by following the instructions on the proxy card or (2)voting instruction form.

If you are a stockholder of record voting by votingtelephone or the Internet, your proxy must be received by 8:59 p.m. Pacific Time (11:59 p.m. Eastern Time) on October 20, 2021, in person at the meeting.

Iforder for your shares are registered in the name of a broker, bank or other nominee, you will receive a voting instruction form from your broker, bank or other nominee that can be used to instruct how your shares will be voted at the Annual Meeting. You may also be eligible to submit voting instructions electronically over the Internet or by telephone. A large numberHowever, if you are a stockholder of banks and brokerage firms are participating in the Broadridge Financial Solutions, Inc. (“Broadridge”) online program. If your bank or brokerage firm is participating in Broadridge’s program, your voting instruction form will provide instructions for such alternative methods of voting. If you submit your voting instructions via the Internet or by telephone, you do not have to return your voting instruction form by mail.

If yourrecord submitting a proxy card or voting instruction form does not reference Internet or telephone information, please completeby mail, you may instead mark, sign and returndate the paper proxy card or voting instruction form. Sign and date each proxy card or voting instruction form you receivereceived and return it in the postage-paid envelope.accompanying prepaid and addressed envelope so that it is received by us before the Annual Meeting. If you hold your shares in street name, please provide your voting instructions to the broker, bank or other nominee who holds your shares by the deadline specified by such broker, bank or nominee.

If you return your signed proxy card or voting instruction form but do not mark the boxes showing how you wish to vote, your shares will be votedFORelection to our Board of Directors of each of the three nominees for director named in Proposal 1 of this Proxy Statement;FORthe ratification of the appointment of RSM US LLP as our independent registered public accounting firm for fiscal 2018,2022, as outlined in Proposal 2 of this Proxy Statement; and FORthe approval, on an advisory basis, of the Company’s executive compensation, as outlined in Proposal 3 of this Proxy Statement;Statement. See “What happens if my shares are held by a broker?” below for information on how your shares will be voted if you are a beneficial owner and1 YEARwith respect do not submit voting instructions to the approval, on an advisory basis,broker, bank or other nominee who holds your shares.

Voting at the Annual Meeting

All stockholders of record may vote in person at the frequencyAnnual Meeting. Even if you plan to attend the Annual Meeting, we recommend that you submit your proxy or voting instructions in advance to authorize the voting of future advisory votes onyour shares at the Company’s executive compensation, as outlined in Proposal 4 of this Proxy Statement.Annual Meeting so that your vote will be counted if you later are unable to attend. If you later attend and vote at the Annual Meeting, your previously submitted proxy or voting instructions will not be used.

Can I revoke my proxy or change my vote?

You have the right to revoke your proxy or voting instruction form at any time before your shares are voted at the Annual Meeting. If you are a stockholder of record, you may revoke your proxy by:

notifyingdelivering a written revocation to our corporateCorporate Secretary (Michelle Gouvion) in writing;

signing and returningsubmitting a later-dated proxy card;

submitting a new proxy electronically via the Internet, telephone or by telephone;mail, as described above under “Voting via the Internet, Telephone or

voting in person at the Annual Meeting.

If you are the beneficial owner of shares held in “street name” by a broker, bank or nominee, you may change your vote by submitting new voting instructions to your broker, bank or nominee, or, if you have obtained a legal proxy from your broker, bank or nominee giving you the right to vote your shares at the Annual Meeting, by attending the Annual Meeting and voting in person.

Please note that attendance at the Annual Meeting will not by itself constitute revocation of a proxy.

What is the deadline for voting my shares?

If you are a stockholder of record, please mark, sign, date and return the enclosed proxy card, which must be received before the polls close at the Annual Meeting in order for your shares to be voted at the meeting. If you are a beneficial stockholder, please follow the voting instructions provided by the bank, broker or other nominee who holds your shares.

How will voting on any other business be conducted?

Other than the proposals described in this Proxy Statement, we know of no other business to be considered at the Annual Meeting. However, if any other matters are properly presented at the meeting or any postponement or adjournment thereof, your proxy, if properly submitted, authorizes Kate W. Duchene, our President and Chief Executive Officer, or Herbert M. Mueller,Jennifer Y. Ryu, our Executive Vice President and Chief Financial Officer, to vote in their discretion on those matters.

Who will count the votes?

American Stock Transfer and Trust CompanyA representative of Broadridge will count the votes.

Who will bear the cost of soliciting votes?

The solicitation of proxies will be conducted electronically through the Internet and by mail, and the Company will bear all attendant costs. These costs include the expense of preparing and mailing proxy solicitation materials and reimbursements paid to brokerage firms and others for their expenses incurred in forwarding solicitation materials to beneficial owners of the Company’s common stock. The Company may conduct further solicitation personally, telephonically, or through the Internet or by facsimile through its officers, directors and employees, none of whom will receive additional compensation for assisting with

the solicitation. At this time, the Company does not anticipate engaging the services of a proxy solicitor. The Company may incur other expenses in connection with the solicitation of proxies.

What does it mean if I receive more than one proxy card or voting instruction form?

It probably means your shares are registered differently and are in more than one account. Please sign and return each proxy card or voting instruction form you receive or, if available, submit youra proxy or voting instructions electronically viafor each of your accounts in the Internet or by telephone by followingmanner provided above under “How do I vote and what is the instructions set forth on each proxy card or voting instruction form,deadline?” to ensure all your shares are voted.

How many shares can vote?

As of the close of business on the record date, 29,899,42633,186,740 shares of our common stock, including unvested shares of restricted stock, were outstanding. Each share of our common stock outstanding and each unvested share of restricted stock with voting rights on the record date is entitled to one vote on each of the three director nominees and one vote on each other matter that may be presented for consideration and action by the stockholders at the Annual Meeting.

What is the voting requirement for each of the above matters?

Proposal 1. Election of Directors. Once a quorum has been established, under our Third Amended and Restated Bylaws, (our “Bylaws”), each director nominee must receive the affirmative vote of a majority of the votes cast with respect to that director’s election in order to be elected to our Board of Directors (that is, the number of shares voted “FOR”“FOR” the director nominee must exceed the number of votes cast “AGAINST” that director nominee). Each stockholder will be entitled to vote the number of shares of common stock held as of the close of business on the record date by that stockholder for each director position to be filled.nominee. Stockholders will not be allowed to cumulate their votes in the election of directors.

If any of the director nominees named in Proposal 1, each of whom is currently serving as a director, is not elected at the Annual Meeting by the requisite majority of votes cast, under Delaware law, the director would continue to serve on the Board of Directors as a “holdover director.” However, under our Bylaws, any incumbent director who fails to receive a majority of the votes cast must tender his or her resignation to the Secretary of the Company promptly following certification of the election results. In such circumstances, the Board, of Directors, taking into account the recommendation of the Corporate Governance and Nominating Committee of the Board, of Directors, must decide whether to accept or reject the resignation and publicly disclose its decision, including the rationale behind any decision to reject the tendered resignation, within 90 days following certification of the election results.

Other Proposals. Once a quorum has been established, under our Bylaws, approval of Proposals 2 and 3 and 4each requires the affirmative vote of stockholders holding a majority in voting power of those shares present in person or represented by proxy at the meeting and entitled to vote on the matter. Notwithstanding the above,foregoing, please be advised that each of Proposals 2 3 and 43 is advisory only and not binding on the Company or our Board of Directors.Board. Our Board of Directors will consider the outcome of the vote on each of these items in considering what actions, if any, should be taken in response to the advisory votes by stockholders. In addition, with respect to Proposal 4, if no frequency option receives the affirmative vote of a majority of the shares present in person or by proxy at the meeting and entitled to vote on the matter, our Board of Directors will consider the option receiving the highest number of votes cast as the preferred frequency option of our stockholders.

What constitutes a quorum?

In order to transact business at the Annual Meeting, a quorum must be present. Under Delaware law and our Bylaws, a quorum is present if a majority in voting power of the outstanding shares of our common stock outstandingentitled to vote at the meeting on the record date are present, in person or by proxy, and entitled to vote at the Annual Meeting. Because there were 29,899,42633,186,740 shares of common stock outstanding as of the close of business on the record date, holders of at least 14,949,71316,593,371 shares of our common stock will need to be present in person or by proxy at the Annual Meeting for a quorum to exist to transact business at the Annual Meeting.

What happens if my shares are held by a broker?

If you are the beneficial owner of shares held in “street name” by a broker, the broker, as the record holder of the shares, is required to vote those shares in accordance with your instructions. If you do not give instructions to the broker, the broker will nevertheless be entitled to vote the shares with respect to “routine” matters but will not be permitted to vote the shares with respect to “non-routine” matters. The ratification of the appointment of the Company’s independent registered public accounting firm in Proposal 2 is considered a routine matter and may be voted upon by your broker if you do not give instructions. However, brokers do not have discretionary authority to vote your shares on your behalf for any of the other items to be submitted for a vote of stockholders at the Annual Meeting (the election of directors or the advisory vote on the Company’s executive compensation and the advisory vote on the frequency of future advisory votes on the Company’s executive compensation). Accordingly, if you are a beneficial owner that has not submitted voting instructions to your broker and your broker exercises its discretion to vote your shares on Proposal 2, your shares will be treated as broker non-votes with respect to Proposals 1 3 and 43 (the election of directors and the advisory vote on the Company’s executive

compensation, and the advisory vote on the frequency of future advisory votes on the Company’s executive compensation)respectively). There will not be any broker non-votes on Proposal 2 (ratification of the appointment of the Company’s independent registered public accounting firm for fiscal year 2018)2022).

How will “broker non-votes” and abstentions be treated?

Broker non-votes with respect to Proposals 1 3 and 43 (the election of directors the advisory vote on the Company’s executive compensation and the advisory vote on the frequency of future advisory votes on the Company’s executive compensation) are counted for the purposes of calculating a quorum. However, when the broker notes on the proxy card that it lacks discretionary authority with respect to these matters and has not received voting instructions from the beneficial owner, those sharesnon-votes are not deemed to be a vote cast with respect to Proposal 1 or entitled to vote for the purpose of determining whether stockholders have approved the matterProposal 3 and, therefore, will not be counted in determining the outcome of the matter.such matters.

A properly executed proxy marked “ABSTAIN” with respect to the election of one or more director nominees in Proposal 1 will not be votedconsidered a vote cast with respect to the director or director nominees indicated and, therefore, will not be counted in determining the outcome of the director nominee’s election to the Board of Directors.Board. For the remaining Proposals, a properly executed proxy marked “ABSTAIN” with respect to the proposal has the same effect as a vote “AGAINST” the matter or, in the case of Proposal 4, a vote not in favor of any of the proposed frequency options.matter. In all cases, a properly executed proxy marked “ABSTAIN” will be counted for purposes of determining whether a quorum is present.

When must notice of business to be brought before an annual meeting be given and when are stockholder proposals and director nominations due for the 20182022 annual meeting?

Advance Notice Procedures. Under our Bylaws, business, including director nominations, may be brought before an annual meeting if it is specified in the notice of the meeting or is otherwise brought before the meeting by or at the discretion of our Board of Directors or by a stockholder entitled to vote who has delivered notice to our corporate secretaryCorporate Secretary (containing certain information specified in our Bylaws) not earlier than the close of business on the 120th day and not later than the close of business on the 90th day prior to the first anniversary of the preceding year’s annual meeting (for next year’s annual meeting, no earlier than the close of business on June 21, 2018,23, 2022, and no later than the close of business on July 21, 2018)23, 2022). In the event that the date of the annual meeting is advanced more than 30 days prior to or delayed by more than 70 days after the anniversary of the preceding year’s annual meeting, notice by the stockholder must be delivered to our Corporate Secretary not earlier than the close of business on the 120th day prior to such annual meeting and not later than the close of business on the later of the 90th day prior to such annual meeting or the 10th day following the day on which public announcement of the date of such meeting is first made. These requirements are separate from

and in addition to the requirements of the SEC that a stockholder must meet in order to have a stockholder proposal included in next year’s proxy statement.

Stockholder Proposals for the 20182022 Annual Meeting. Written notice of stockholder proposals to be considered for inclusion in the proxy statement and form of proxy relating to the 20182022 annual meeting of stockholders must be received no later than May 18, 2018.10, 2022. In addition, all proposals will need to comply with Rule 14a-8 under the Securities Exchange Act, of 1934 (the “Exchange Act”), which lists the requirements for the inclusion of stockholder proposals in company-sponsored proxy materials.

How do I obtain a copy of the Annual Report on Form 10-K thatfor Resources Connection, filed with the SEC?Inc.’s year ended May 29, 2021?

A copy of the Company’s most recent Annual Report for the year ended May 29, 2021 has been included with this Proxy Statement. If you desire another copy of our Annual Report or would like a copy of our Annual Report on Form 10-K filed with the SEC (including the financial statements and the financial statement schedules),we will provide one to you free of charge upon your written request to our Investor Relations Department at 17101 Armstrong Avenue, Irvine, California 92614, or from our Investor Relations website athttp:https://ir.rgp.comir.rgp.com/financials-filings/annual-reports-and-proxies.

How may I obtain a separate set of proxy materials?

If you share an address with another stockholder and did not receive a Notice of Internet Availability or otherwise receive your proxy materials electronically, you may receive only one set of proxy materials (including this Proxy Statement and our Annual Report) unless you have provided contrary instructions. If you wish to receive a separate set of proxy materials for this year or future years, please request the additional copies by contacting our Investor Relations Department at 17101 Armstrong Avenue, Irvine, California 92614, or by telephone at 714-430-6400. A separate set of proxy materials will be sent promptly following receipt of your request.

IfIn addition, if you are a stockholder of record and wish to receive a separate set of proxy materials in the future, or if you are a stockholder at a shared address to which we delivered multiple copies of this Proxy Statement or the Annual Report and you desire to receive one copy in the future, please contact our Investor Relations Department at 17101 Armstrong Avenue, Irvine, California 92614, or by telephone at 714-430-6400.

If you hold shares beneficially in street name, please contact your broker, bank or nominee directly if you have questions, require additional copies of this Proxy Statement or our Annual Report, or wish to receive multiple reports by revoking your consent to house holding.

PROPOSAL 1. ELECTION OF DIRECTORS

Our Board of Directorscurrently consists of nineeleven directors. Our Amended and Restated Certificate of Incorporation provides for a classified Board of Directors consisting of three classes of directors, each serving staggered three-year terms. At this year’s Annual Meeting, we will be electing three directors, each to serve a term of three years expiring at our 20202024 Annual Meeting and until his or her successor is duly elected and qualified. Michael H. Wargotz is not standing for re-election at the Annual Meeting.

Due to Mr. Wargotz not standing for re-election, only three directors will be serving in the class up for election at the Annual Meeting. Because the Board has nominated only three director nominees for election at the Annual Meeting for a three-year term expiring at the 2024 Annual Meeting, shares may not be voted for more than three director nominees. Our Board intends to reduce the number of directors to ten following the Annual Meeting.

Each of the nominees, Donald B. Murray, Lisa M. Pierozzi and A. Robert F. Kistinger, Jolene Sarkis and Anne Shih,Pisano, is presently a member of our Board, of Directors, having served on the Company’s Board since 2006,1999, 2021 and 2002, respectively. Messrs. Murray and Pisano were previously elected to our Board by our stockholders at our 2018 annual meeting of stockholders. This will be the first time Ms. Pierozzi will stand for election by our stockholders, after initially being appointed as a director by our Board following the recommendation of the Corporate Governance and Nominating Committee in February 2021. Ms. Pierozzi was initially identified as a director candidate by Mr. Pisano, our Lead Independent Director and Chairman of our Corporate Governance and Nominating Committee.

In addition, notwithstanding the Company’s retirement age policy, the Board affirmatively requested that each of Messrs. Murray and Pisano continue their service to the Board for an additional three-year term given their outstanding contributions, deep knowledge of the professional services industry and executive experience. Mr. Murray founded Resources Connection, Inc. in 1996, has served in various leadership positions with the Company and currently serves as Chairman of the Board. Mr. Pisano has served on the Board since 2002 and 2007, respectively.as the Lead Independent Director since 2004. The continued services of Messrs. Murray and Pisano contributes to the stability of the Board. Additionally, each possesses a unique blend of leadership, institutional knowledge and experience that our Board of Directors,requires to lead the Company through key enterprise initiatives and as we continue our board refreshment efforts.

Our Board, acting upon the recommendation of the Corporate Governance and Nominating Committee, recommends thethat stockholders vote in favor of the election of each of the nominees, named in this Proxy Statement to serve as members of our Board of Directors. (See “Director Nominees” below).Messrs. Murray and Pisano and Ms. Pierozzi.

In recommending director nominees for selection by the Board, the Corporate Governance and Nominating Committee considers a number of factors, which are described in more detail below under “Board of Directors —Corporate— Corporate Governance and Nominating Committee.” In considering these factors, the Corporate Governance and Nominating Committee and the Board consider the gender, ethnic and racial diversity of each nominee along with the fit of each individual’s qualifications, skills and skillsattributes with those of the Company’s other directors in order to build a Board of Directors that, as a whole, is effective, collegial and responsive to the Company and its stockholders.

The six There are no family relationships among our directors whose terms do not expire in 2017 are expectedor executive officers nor any arrangements or understandings between any director and any other person pursuant to continue to serve after the Annual Meeting until such timewhich a director was selected as their respective terms of office expire and their respective successors are duly elected and qualified. (See “Continuing Directors” below.)a director or nominee.

If at the time of the Annual Meeting any of the nominees should beis unable or unwilling for good cause to serve if elected, the persons named as proxyproxies on the proxy card will vote for such substitute nominee or nominees, if any, as our Board of Directors recommends or, if no substitute nominee is recommended by our Board, of Directors, for the remaining nominees, leaving a vacancy, unless our Board of Directors chooses to reduce the number of directors serving on the Board. Each of the nominees has consented to be named in this Proxy Statement and to serve if elected.

Following is biographical information about each nominee and each director.other director who will continue as a director after the Annual Meeting. This description includes the principal occupation of and directorships held by each director for at least the past five years, as well as the specific experience, qualifications, attributes and skills that led to theour Board’s conclusion that each nominee and director should serve as a member of the Company’s Board of Directors.

The individuals standing for election are:

| ||

| ||

| ||

The Board of Directors unanimously recommends that stockholders vote FOR each of the nominees set forth above.

The following persons are the members of our Board of Directors whose terms of office do not expire until after the Annual Meeting and who are therefore not standing for re-election at the Annual Meeting:

| ||

| ||

| ||

Donald B. Murray

74

| Mr. Murray founded Resources Connection, Inc. in June 1996 and served as our Managing Director from inception until April 1999. From April 1999 through May 2008, Mr. Murray served as our Chairman, President and Chief Executive Officer and

| |

| Key experience, qualifications, attributes and skills: | ||

| In addition to his career credentials as a partner with Deloitte & Touche LLP, as the Company’s founder, | ||

| Lisa M. Pierozzi Age 60 Director since February 2021 | Ms. Pierozzi formerly served as Executive Vice President, Finance & Administration and Chief Financial Officer of the Motion Picture Association (“MPA”) from 2006 to 2011. Prior to her role at MPA, Ms. Pierozzi was Senior Vice President, Business Planning and Development for Universal Studios’ global theme parks and resorts group from 2001 to 2005. Ms. Pierozzi joined PwC (formerly Price Waterhouse) in 1984 and was a partner from 1997 to 2001, where she had leadership roles in multiple industry transactions and operational reviews, including deal structuring and assessment, due diligence, financing, process improvement, systems and infrastructure overview. Ms. Pierozzi currently sits on the board of directors of the Motion Picture & Television Fund (“MPTF”) and is a founding member of the Normandy Institute. Ms. Pierozzi’s experience includes serving as chairman of the Audit Committee, of the MPTF as well as a nonvoting member of the Finance and Investment Committees and various other special committees of the MPTF. | |

| Key experience, qualifications, attributes and skills: | ||

| Ms. Pierozzi brings to our Board more than 35 years of experience as a financial professional and advisor in leadership roles for both public and private companies, with particular expertise in public company financial reporting, systems and controls. | ||

| A. Robert Pisano

78

| Mr. Pisano has served as our Lead Independent Director since 2004. Mr. Pisano is a business consultant, an activity he began in September |

| Key experience, qualifications, attributes and skills: | ||

| Mr. Pisano’s 20 years of experience as a partner specializing in business litigation while at O’Melveny & Myers LLP, followed by his hands-on management of international business operations, marketing and business development while employed by the leaders in the entertainment industry provide a wealth of experience, especially in the areas of acquisitions and legislative and regulatory affairs, to | ||

Our Board unanimously recommends that stockholders vote “FOR” Proposal 1 to elect to the Board each of the three director nominees set forth above.

The following persons are the members of our Board whose terms of office do not expire until after the Annual Meeting and who will continue to serve on the Board after the Annual Meeting:

67

| In 2016, Mr. | |

| Key experience, qualifications, attributes and skills: | ||

| Mr. | ||

| Neil F. Dimick Age 72 Director since November 2003 Mr. Dimick’s term of office as one of our directors expires at the Annual Meeting in 2022. | Prior to joining our Board, Mr. Dimick served as Executive Vice President and Chief Financial Officer of AmerisourceBergen Corporation, a pharmaceutical services provider, from August 2001 to May 2002. He served as Senior Executive Vice President and Chief Financial Officer of Bergen Brunswig Corporation, as well as a director and a member of the Bergen board’s Finance, Investment and Retirement Committees, for more than | |

| Key experience, qualifications, attributes and skills: | ||

| Mr. Dimick brings to our Board, and the Audit Committee that he chairs, more than 25 years of public accounting experience, including eight years as a partner at Deloitte & Touche LLP, experience as a Chief Financial Officer for a large-cap publicly traded international company and continued involvement with public company boards and board committees, all of which provide our Board with in-depth knowledge of the many critical financial | ||

| Kate W. Duchene Age 58 Director since January 2018 Ms. Duchene’s term of office as one of our directors expires at the Annual Meeting in 2022. | Ms. Duchene is our President and Chief Executive Officer, a position to which she was promoted in December 2016. Between 1999 and 2016, Ms. Duchene was our Chief Legal Officer, Secretary and Executive Vice President of Human Resources. From 2012 to 2016, Ms. Duchene also assumed leadership |

| Key experience, qualifications, attributes and skills: | |

| As our President and Chief Executive Officer, Ms. Duchene brings to our Board valuable leadership experience and a deep and thorough understanding of our operations, the day-to-day management of our business and our industry as a whole. | |

| Robert F. Kistinger Age 68 Director since August 2006 Mr. Kistinger’s term of office as one of our directors expires at the Annual Meeting in 2023 | Mr. Kistinger was the Chief Operating Officer of Bonita Banana Company from 2009 to 2014 and now continues to serve as an Executive Advisor to the company. He was formerly President and Chief Operating Officer of the Fresh Group of Chiquita Brands International, Inc. (“Chiquita”). Mr. Kistinger was employed at Chiquita for Key experience, qualifications, attributes and skills: Mr. Kistinger has held leadership positions in large multinational companies with operations in Latin America, developing critical financial and international operations expertise. Mr. Kistinger’s knowledge, insight and experience are invaluable to the Company and to the Board as we continue to provide services and solutions to our clients around the world. |

| Marco von Maltzan Age 66 Director since July 2018 Mr. von Maltzan’s term of office as one of our directors expires at the Annual Meeting in 2023 | Mr. von Maltzan, in addition to having served as the Chairman of the Supervisory Board of taskforce — Management on Demand AG, served as the Chairman of the Supervisory Board of industrial holding Greiffenberger AG from 2016 through June 2021, and, since 2015, has been the Deputy Chairman of the Shareholder Committee and member of the Audit Committee of food conglomerate Pfeifer & Langen Industrie- und Handels-KG. Mr. von Maltzan started his professional career in 1983 with top management consulting firm Roland Berger. In 1987, he joined BMW Group where he held various senior management positions, acting lastly as Chief Executive Officer of BMW Motorrad, BMW’s motorcycle division from 1999 to 2002. From 2003 to 2007, Mr. von Maltzan served as Chief Executive Officer of automotive supplier BERU AG which was sold to Michigan-based BorgWarner, Inc. From 2008 to 2011, Mr. von Maltzan acted as Chief Executive Officer of Profine Group, a leading producer of PVC profiles. Mr. von Maltzan has also held various board |

| Key experience, qualifications, attributes and skills: Mr. von Maltzan brings to our Board over 35 years of international and industry-specific operational experience. This experience uniquely qualifies him to advise the Company in its international growth strategy. |

| Jolene Sarkis Age 71 Director since April 2002 Ms. Sarkis’ term of office as one of our directors expires at the Annual Meeting in 2023 | Ms. Sarkis has been a private marketing and advertising consultant since 2001. Ms. Sarkis held various positions of responsibility for Time Inc. from 1985 to 2001 in sales and marketing, primarily for Time Inc.’s leading publications which include Time, People, Sports Illustrated, Fortune and Money. Ms. Sarkis served as Publisher of Fortune from 1996 to 2001 and, additionally, as President of Fortune from 1999 to 2001. In 2019, she retired as Executive Vice President of the CFS Restaurant Group, a position she held since 2011. |

| Key experience, qualifications, attributes and skills: | |

| Ms. Sarkis’ executive business experience in operations management and business development brings a unique skill set to our Board and to the Company in the critical areas of leadership and strategic planning, as well as marketing and human resources. | |

| David P. White Age 53 Director since July 2021 Mr. White’s term of office as one of our directors expires at the Annual Meeting in 2023 | Mr. White previously served as the National Executive Director and Chief Negotiator of the Screen Actors Guild-American Federation of Television and Radio Artists (“SAG-AFTRA”) from 2009 to June 2021. Prior to rejoining SAG-AFTRA in 2009, where he previously served as General Counsel from 2002 to 2006, Mr. White was Managing Principal of Los Angeles-based Entertainment Strategies Group LLC from 2006 to 2009, providing consulting services to the entertainment industry. He was also previously a labor and employment attorney at O’Melveny & Myers LLP. Mr. White is a Rhodes Scholar and a graduate of Grinnell College, Stanford Law School and The Queen’s College, Oxford University. He currently serves as a board member of the Federal Reserve Bank of San Francisco, where he serves on the Audit and Risk Management Committee and Bank Governance Committee, as a board member of the MPTF, where he serves on the Audit Committee, and as a board member of The Actors Fund, where he serves on the Strategic Planning Committee. Mr. White also serves as a commissioner for the Entertainment Industry Commission on Eliminating Sexual Harassment and Advancing Equality in the Workplace. |

| Key experience, qualifications, attributes and skills: | |

| Mr. White brings to our Board over 20 years of legal and executive leadership expertise, with extensive expertise in human capital and regulatory matters all of which makes him a trusted advisor to the Company. |

The Board of Directors unanimously recommends a vote FOR election to the Board of Directors of each of the three director nominees named in this Proxy Statement.

The following table sets forth information about our current executive officers. Each of our executive officers serves at the pleasure of the Boardour Board. There are no family relationships among our directors or executive officers nor any arrangements or understandings between any of Directors:our executive officers and any other person pursuant to which an officer was selected.

|  |  |  | ||||

| |||||||

Kate W. Duchene | (58) President, Chief Executive Officer and Director Ms. Duchene has served as our President | ||||||